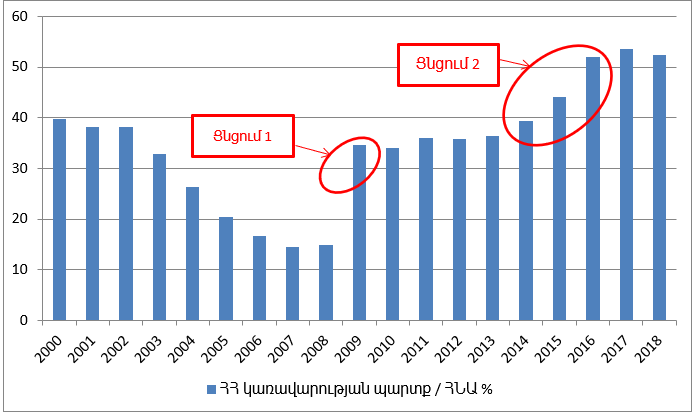

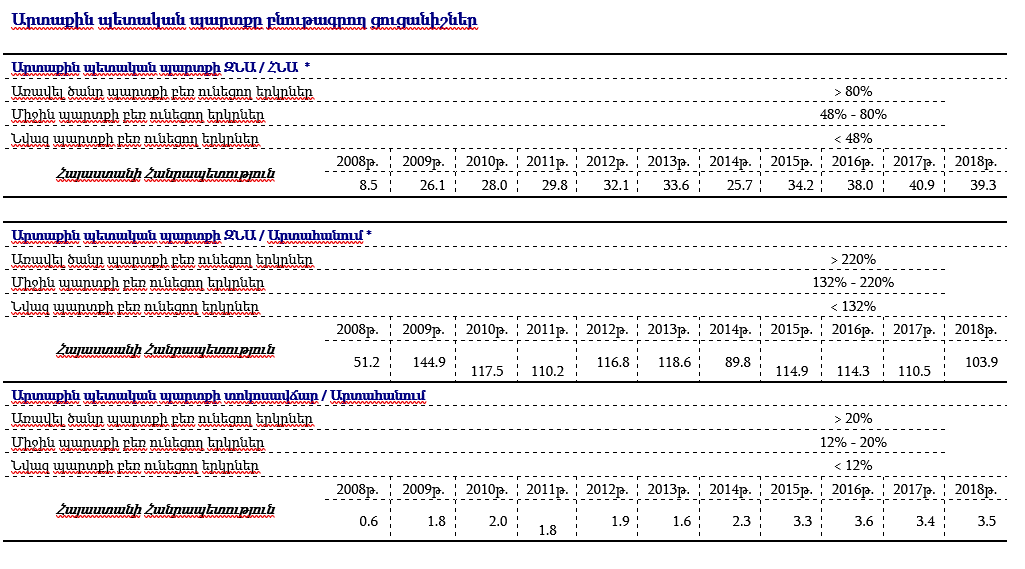

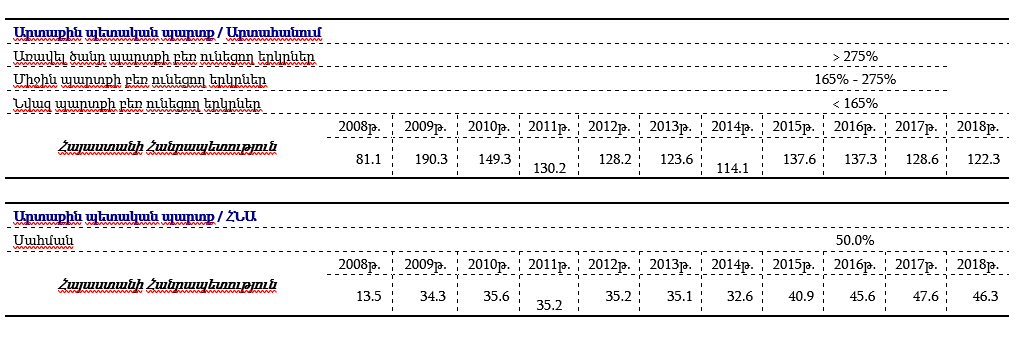

Since 2016, the new Government has set a task to gradually slow down the growth rate of the Government debt / GDP ratio, which had grown by 13 percentage points in 2014-2016, and only in 2016 - by 7.7 percentage points (the one-off reduction of this indicator would have penalized the economic growth).

In 2017, the Government succeeded in accomplishing its task, which resulted in significant reduction of the debt / GDP growth rate, and the debt / GDP ratio only grew by 1.8 percentage points as a result of fiscal consolidation. Afterwards, in 2018, with the implementation of the fiscal program, the reduction of the debt / GDP ratio is expected to be by about 1.3 percentage points.

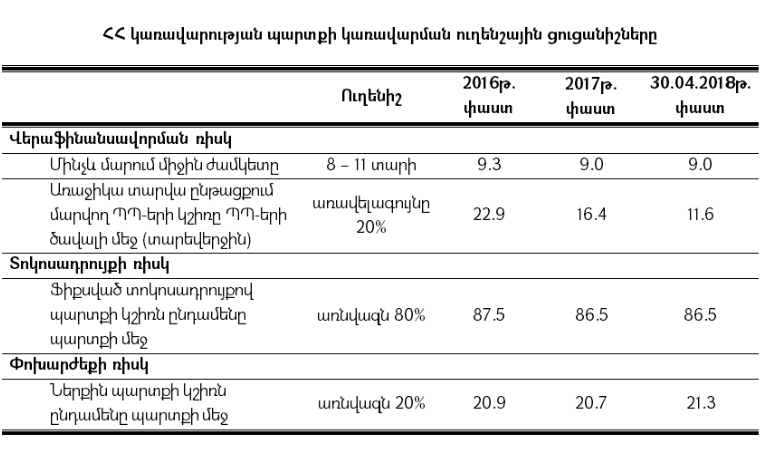

The above-mentioned fiscal policy has been implemented in line with the sound governance guidelines. Moreover, “the proportion of PDs expended during the next year in the amount of PDs (at the end of the year)” indicator, which describes the risks associated with realizability of the government in debt management (the larger the current year’s repayments in the overall debt are, the more possible it is for the Government to have difficulties in current realizability), decreased from 22.9% in 2016 to 16.4% in 2017, being within the limits of realizability. At the same time this tendency continued in 2018 as well.

A number of reforms have been implemented during this period in the RA Government's internal debt management:

- in order to develop the RA government treasury securities market and to reduce the operational costs for the participants of the market, the auction system of the primary placement of securities has been moved from the RA Central Bank to NASDAQ OMX, whereby the securities transactions are executed on the basis of (T + n) principle, postponing the transaction implementation date from that of the auction;

- the online retail trading system of securities via Treasury Direct (gp.minfin.am) has been introduced and the securities toolkit sold through the Treasury Direct has been expanded. Currently, all the 4 types of issued securities can be purchased through this system;

- a system of behaviour assessment and selection of the primary market participants of government treasury securities was introduced;

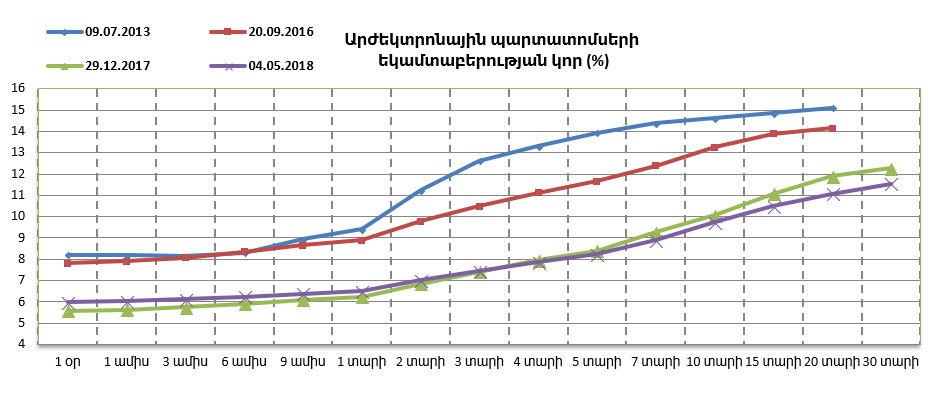

- in 2017, government treasury securities with a maturity of 30 years were issued.

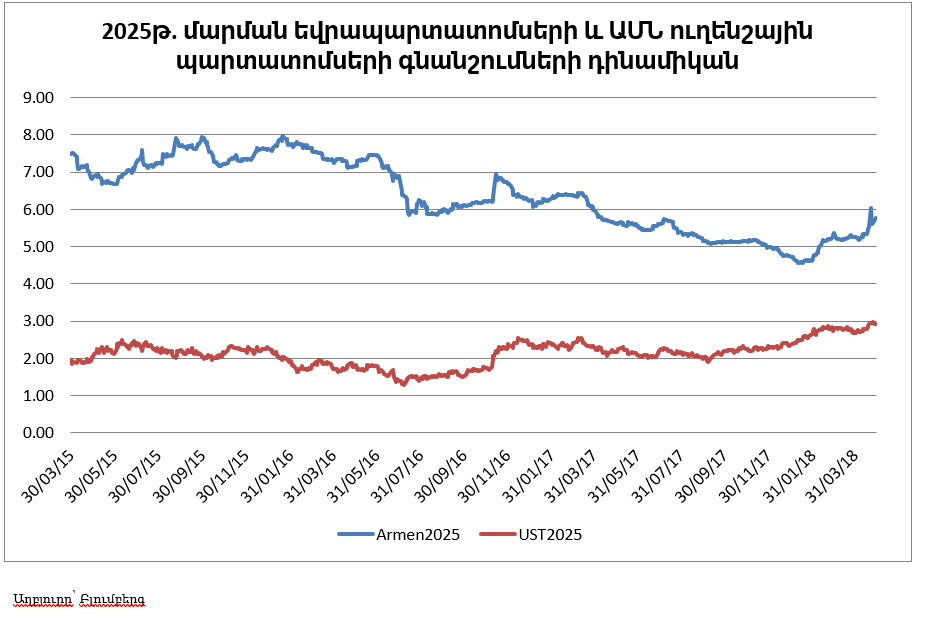

As a result, the yield of government securities has dropped by 3-4 percentage points along the entire curve.

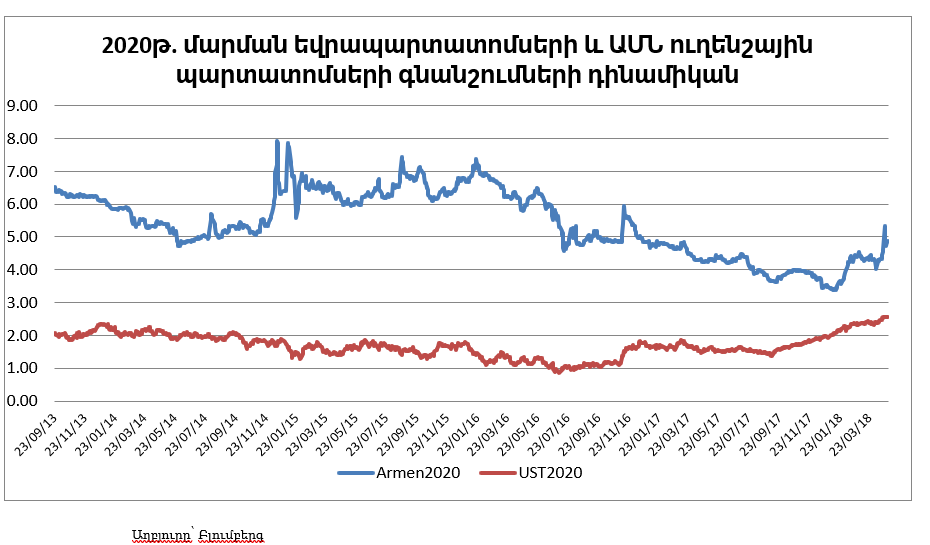

As a result of the RA Government's debt management policy, the response of international capital markets was not late and not only the interest rates of Eurobonds issued by Armenia fell in this period, but also the spread towards the international benchmark bonds decreased, which means that confidence in our country has increased.